Your Threshold reporting real estate california images are available in this site. Threshold reporting real estate california are a topic that is being searched for and liked by netizens today. You can Find and Download the Threshold reporting real estate california files here. Download all royalty-free photos and vectors.

If you’re searching for threshold reporting real estate california images information connected with to the threshold reporting real estate california keyword, you have pay a visit to the ideal site. Our website always provides you with suggestions for downloading the highest quality video and image content, please kindly hunt and find more enlightening video articles and graphics that match your interests.

Threshold Reporting Real Estate California. A Meets or expects to meet the threshold criteria of Business and Professions Code BPC 10232. MarriedRegistered domestic partner RDP. A broker who fails to submit the Escrow Activity Report is subject to a penalty of 50 per day for each day the report has not been received by the Department up to and including the 30th day. Federal Estate Tax.

What Are The 1 And 2 Rules In Real Estate Investing From realwealthnetwork.com

What Are The 1 And 2 Rules In Real Estate Investing From realwealthnetwork.com

SMLLCs which are disregarded entities for income tax purposes should prepare Schedule IW by entering the California amounts attributable to the disregarded entity from the members federal Schedule B C D E F Form 1040 or additional schedules associated with other activities. A broker who fails to submit the Escrow Activity Report is subject to a penalty of 50 per day for each day the report has not been received by the Department up to and including the 30th day. The governing withholding laws California Code of Regulations Title 18 Sections 18662-0 through 18662-6 and Section 18662-8. Visit IRSs Tips on Rental Real Estate Income Deductions and Recordkeeping for more information. The SCO accepts the standard NAUPA II reporting format. As long as you met the reporting requirement threshold of 100000 at any time in the year you must report on Form T1135 all specified foreign properties held during the year even if you sold any or all of the property before the end of the year.

The form is on the DRE Web site.

What about brokers who already submit Business Activity Reports because they perform private fund transactions and meet the reporting criteria as threshold brokers or multi-lender brokers. Amendment to Californias Constitution was the taxpayers collective response to dramatic increases in property taxes and a growing state revenue surplus of nearly 5 billion. The Economic Growth and Tax Relief Reconciliation Act of 2001 phased out the state death tax credit over a four 4 year period beginning January 2002. Any property received with this report will be returned to the holder. This is the second in our multi-part short article series on mandatory mortgage activity disclosures required of California Bureau of Real Estate CalBRE licensees by the CalBRE and the Nationwide Mortgage Licensing System NMLS. Proposition 13 rolled back most local real property or real estate assessments to 1975 market value levels limited the property tax rate to 1 percent plus the rate.

Source: realwealthnetwork.com

Source: realwealthnetwork.com

The report must be completed online. The federal estate tax goes into effect for estates valued at 1118 million and up in 2018. As of January 1 2020 California real estate withholding changed. The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California. SMLLCs which are disregarded entities for income tax purposes should prepare Schedule IW by entering the California amounts attributable to the disregarded entity from the members federal Schedule B C D E F Form 1040 or additional schedules associated with other activities.

Source: pinterest.com

Source: pinterest.com

The governing withholding laws California Code of Regulations Title 18 Sections 18662-0 through 18662-6 and Section 18662-8. You do not have to report the sale of your home if all of the following apply. The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California. The form is on the DRE Web site. We now have one Form 593 Real Estate Withholding Statement.

Source: zillow.com

Source: zillow.com

The annual and quarterly process is Threshold Reporting. We now have one Form 593 Real Estate Withholding Statement. As of January 1 2020 California real estate withholding changed. Your gain from the sale was less than 250000. The report must be completed online.

Source: realwealthnetwork.com

Source: realwealthnetwork.com

The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California. California Classic Properties Inc. Additionally if a broker negotiates more than 200000000 in loans annually he must take part in Threshold Reporting. The BAR includes the mortgage loan activities of a brokers salespersons and broker-associates. Per BP Section 1016607 real estate brokers who act pursuant to BP Sections 10131d 10131e or 101311 and who make arrange or service loans secured by residential 1-4 unit property must also file a Business Activity Report BAR for their respective fiscal years.

Source: pinterest.com

Source: pinterest.com

Effective January 1 2005 the state death tax credit has been eliminated. The Holder Notice Report is due before November 1 of each year May 1 for life insurance companies. The Economic Growth and Tax Relief Reconciliation Act of 2001 phased out the state death tax credit over a four 4 year period beginning January 2002. The form is on the DRE Web site. Per BP Section 1016607 real estate brokers who act pursuant to BP Sections 10131d 10131e or 101311 and who make arrange or service loans secured by residential 1-4 unit property must also file a Business Activity Report BAR for their respective fiscal years.

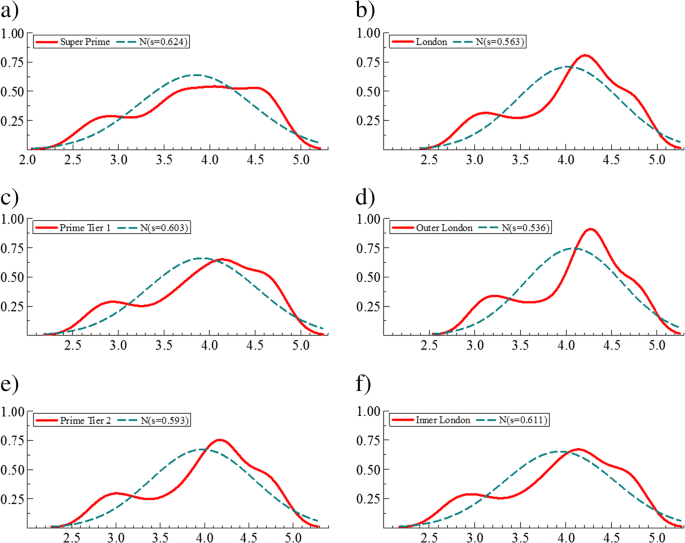

Source: link.springer.com

Source: link.springer.com

A broker who fails to submit the Escrow Activity Report is subject to a penalty of 50 per day for each day the report has not been received by the Department up to and including the 30th day. Even though you wont owe estate tax to the state of California there is still the federal estate tax to consider. The Economic Growth and Tax Relief Reconciliation Act of 2001 phased out the state death tax credit over a four 4 year period beginning January 2002. The federal estate tax goes into effect for estates valued at 1118 million and up in 2018. A broker who fails to submit the Escrow Activity Report is subject to a penalty of 50 per day for each day the report has not been received by the Department up to and including the 30th day.

Source: carealtytraining.com

Source: carealtytraining.com

On and after the 31st day the penalty is 100 per day. The federal estate tax goes into effect for estates valued at 1118 million and up in 2018. Groom carrying bride over the threshold. The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California. Report your rental income and expenses on Part I Income or Loss From Rental Real Estate Royalties on Supplemental Income and Loss Schedule E IRS Form 1040.

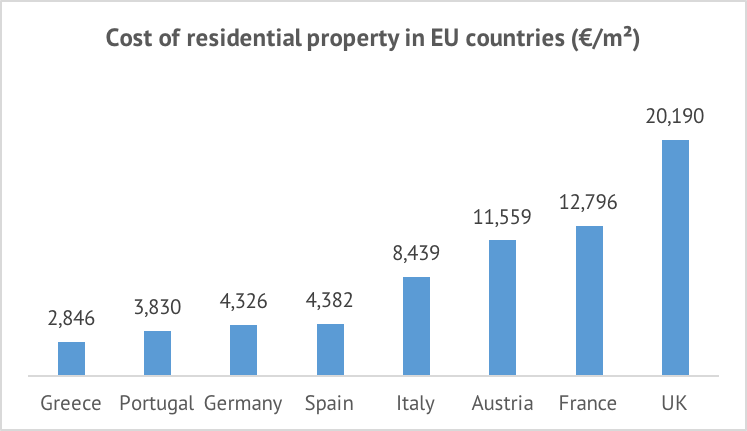

Source: blog.mipimworld.com

Source: blog.mipimworld.com

The federal estate tax goes into effect for estates valued at 1118 million and up in 2018. As of January 1 2020 California real estate withholding changed. This form is to notify the Department of Real Estate DRE when a broker or corporation either. 30 days after the end of each of the brokers fiscal quarters fourth quarter report is not required if filing an annual TAR BPC 10238j4 BPC 10238j5 BPC 10238j6 BPC 10238k3 Annual Trust Account Review TAR If also a threshold reporter submit a combined TAR na. Federal Estate Tax.

Source: propertyshark.com

Source: propertyshark.com

SMLLCs which are disregarded entities for income tax purposes should prepare Schedule IW by entering the California amounts attributable to the disregarded entity from the members federal Schedule B C D E F Form 1040 or additional schedules associated with other activities. Federal Estate Tax. The Realtor entitled to the commission is the one who can demonstrate procuring cause. It is an online submission form. The report is due within 60 days after the end of the calendar year in which the broker met the escrow threshold.

Source: pinterest.com

Source: pinterest.com

For a link to free reporting software visit wwwscocagovupd_rptghtml. We now have one Form 593 Real Estate Withholding Statement. The form is on the DRE Web site. Properties should not be remitted or delivered with the Holder Notice Report. Report your rental income and expenses on Part I Income or Loss From Rental Real Estate Royalties on Supplemental Income and Loss Schedule E IRS Form 1040.

Source: woolcott.ca

Source: woolcott.ca

As long as you met the reporting requirement threshold of 100000 at any time in the year you must report on Form T1135 all specified foreign properties held during the year even if you sold any or all of the property before the end of the year. Additionally if a broker negotiates more than 200000000 in loans annually he must take part in Threshold Reporting. You do not have to report the sale of your home if all of the following apply. Any property received with this report will be returned to the holder. As long as you met the reporting requirement threshold of 100000 at any time in the year you must report on Form T1135 all specified foreign properties held during the year even if you sold any or all of the property before the end of the year.

Source: pinterest.com

Source: pinterest.com

Per BP Section 1016607 real estate brokers who act pursuant to BP Sections 10131d 10131e or 101311 and who make arrange or service loans secured by residential 1-4 unit property must also file a Business Activity Report BAR for their respective fiscal years. This is the second in our multi-part short article series on mandatory mortgage activity disclosures required of California Bureau of Real Estate CalBRE licensees by the CalBRE and the Nationwide Mortgage Licensing System NMLS. Proposition 13 rolled back most local real property or real estate assessments to 1975 market value levels limited the property tax rate to 1 percent plus the rate. As of January 1 2020 California real estate withholding changed. Properties should not be remitted or delivered with the Holder Notice Report.

Source: codetiburon.com

Source: codetiburon.com

What about brokers who already submit Business Activity Reports because they perform private fund transactions and meet the reporting criteria as threshold brokers or multi-lender brokers. A broker who fails to submit the Escrow Activity Report is subject to a penalty of 50 per day for each day the report has not been received by the Department up to and including the 30th day. Any gain over 250000 is taxable. Your gain from the sale was less than 250000. MarriedRegistered domestic partner RDP.

Source: blog.mipimworld.com

Source: blog.mipimworld.com

The annual and quarterly process is Threshold Reporting. The Realtor entitled to the commission is the one who can demonstrate procuring cause. The governing withholding laws California Code of Regulations Title 18 Sections 18662-0 through 18662-6 and Section 18662-8. As of January 1 2020 California real estate withholding changed. As long as you met the reporting requirement threshold of 100000 at any time in the year you must report on Form T1135 all specified foreign properties held during the year even if you sold any or all of the property before the end of the year.

Source: vaned.com

Source: vaned.com

The BAR includes the mortgage loan activities of a brokers salespersons and broker-associates. Effective January 1 2005 the state death tax credit has been eliminated. California Classic Properties Inc. The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California. We now have one Form 593 Real Estate Withholding Statement.

Source: pinterest.com

Source: pinterest.com

California Classic Properties Inc. The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California. Only SMLLCs whose income meets certain threshold amounts are required to complete Schedules B and K. Properties should not be remitted or delivered with the Holder Notice Report. The Economic Growth and Tax Relief Reconciliation Act of 2001 phased out the state death tax credit over a four 4 year period beginning January 2002.

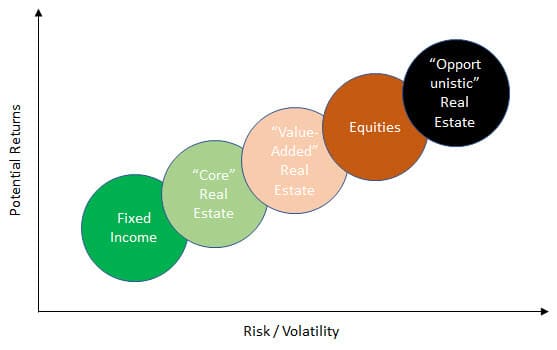

Source: mergersandinquisitions.com

Source: mergersandinquisitions.com

Federal Estate Tax. You owned and occupied the home for at least 2 years. Your gain from the sale was less than 250000. The BAR includes the mortgage loan activities of a brokers salespersons and broker-associates. Report your rental income and expenses on Part I Income or Loss From Rental Real Estate Royalties on Supplemental Income and Loss Schedule E IRS Form 1040.

Source: mergersandinquisitions.com

Source: mergersandinquisitions.com

Proposition 13 rolled back most local real property or real estate assessments to 1975 market value levels limited the property tax rate to 1 percent plus the rate. A Meets or expects to meet the threshold criteria of Business and Professions Code BPC 10232. 30 days after the end of each of the brokers fiscal quarters fourth quarter report is not required if filing an annual TAR BPC 10238j4 BPC 10238j5 BPC 10238j6 BPC 10238k3 Annual Trust Account Review TAR If also a threshold reporter submit a combined TAR na. Federal Estate Tax. SMLLCs which are disregarded entities for income tax purposes should prepare Schedule IW by entering the California amounts attributable to the disregarded entity from the members federal Schedule B C D E F Form 1040 or additional schedules associated with other activities.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title threshold reporting real estate california by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.