Your Real estate tax philippines 2018 images are available. Real estate tax philippines 2018 are a topic that is being searched for and liked by netizens today. You can Download the Real estate tax philippines 2018 files here. Find and Download all free images.

If you’re searching for real estate tax philippines 2018 pictures information linked to the real estate tax philippines 2018 keyword, you have pay a visit to the right blog. Our site frequently provides you with hints for refferencing the maximum quality video and image content, please kindly search and locate more enlightening video articles and images that fit your interests.

Real Estate Tax Philippines 2018. Real property tax rates at 1 to 2 of assessed value Under Section 233 of the Local Government Code of 1991 the following rates of basic real property tax are prescribed based on assessed values of real properties in the Philippines. The National Grid Corporation of the Philippines and distribution companies including electric cooperatives shall be subject to 12 VAT. The exact tax rates depend on the location of the property. Sale of real property is subject to capital gains tax at the rate of 6 on the higher of the gross selling price or fair market value.

Philippines Real Estate Renting And Business Activity Services Value Added Gdp 2018 Statista From statista.com

Philippines Real Estate Renting And Business Activity Services Value Added Gdp 2018 Statista From statista.com

VAT on sale and lease of real properties Beginning 1 January 2021 the VAT exemption shall only apply to sale of real properties not primarily held for sale to. General Guideline for Capital Gain Tax Real Property Tax or Amilyar Documentary Stam Tax other Real Estate Taxes. 4-2019 relative to the availment period for the Tax Amnesty on Delinquencies Published in Manila Bulletin on March 24 2020 Digest Full Text. Theres also a different tax in the Philippines on the transfer itself. The real property tax rate for Metro Manila is 2 of the assessed value of the property while the provincial rate is 1. Valuation of real property is subject to periodic appraisal by the local government.

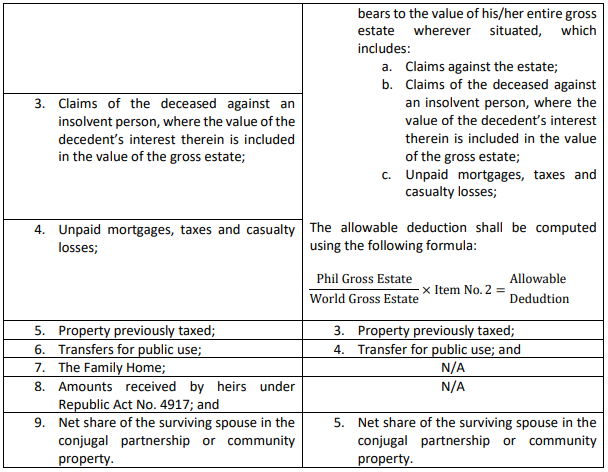

Net Estate Gross Estate Deductions.

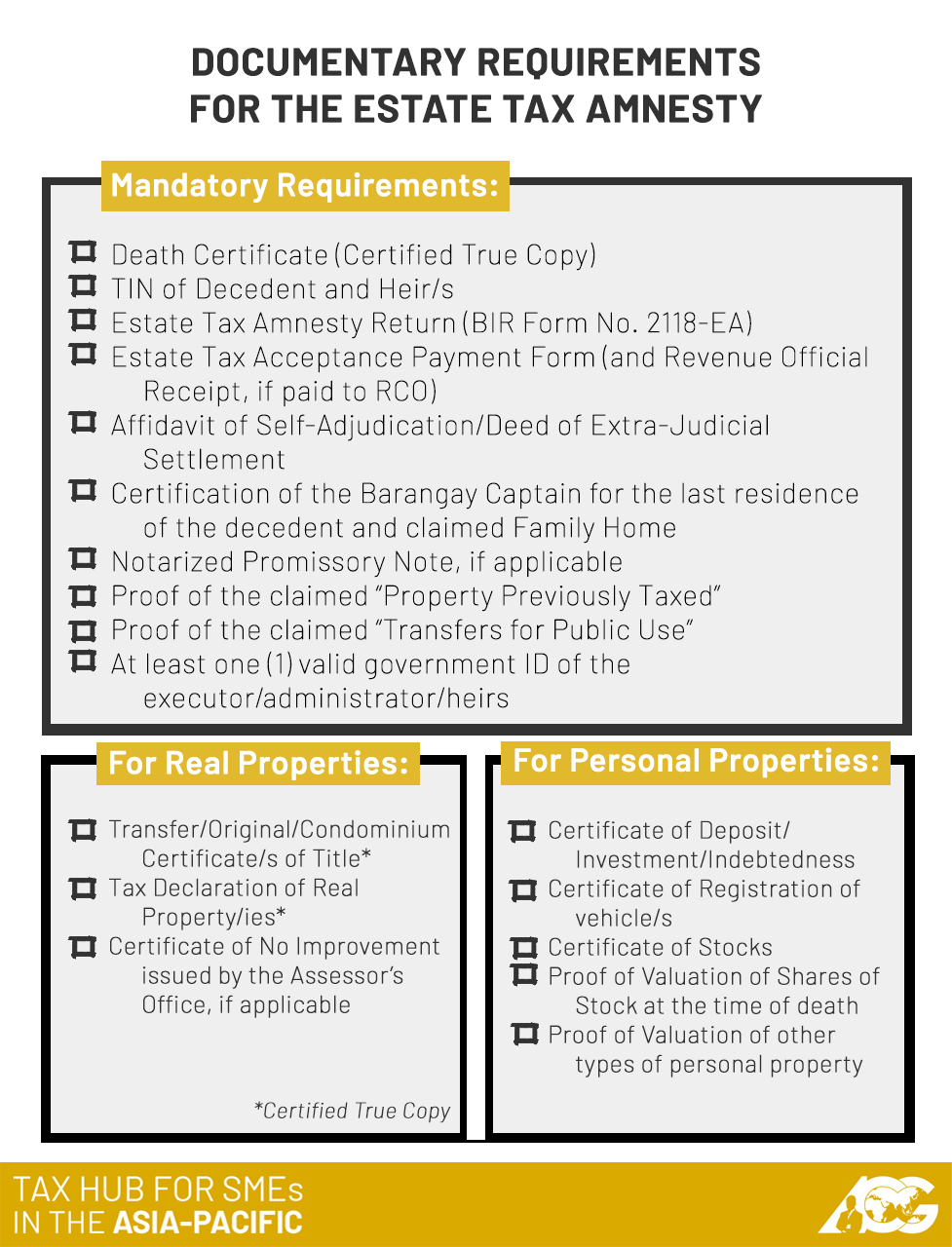

Timestamps 0000 Intro 0058 What is C. The Bureau of Internal Revenue BIR has released Revenue Regulations No. The gift tax applies whether the. The exact tax rates depend on the location of the property. Estate tax is imposed on the transfer of the net estate which is the difference between the gross estate as defined under Section 85 of the Tax Code and allowable deductions under Section 86 of the decedent. Implements the provisions of Estate Tax Amnesty pursuant to the provisions of Republic Act No.

The rate is between 05 -075 varying between municipalities Paid on the highest of the three values listed above Source 1 Source 2 Source 3 3 January 2018. The National Grid Corporation of the Philippines and distribution companies including electric cooperatives shall be subject to 12 VAT. Stamp duty of Php 15 for every Php 1000 will apply to the transfer of real property. Valuation of real property is subject to periodic appraisal by the local government. The exact tax rates depend on the location of the property.

Source: pinterest.com

Source: pinterest.com

The gift tax applies whether the. The Philippines refers to this tax as the donors tax and its imposed on the transfer of real personal tangible or intangible property between two or more people who are living at the time of the transfer when this is given as a gift and no money exchanged hands. If youre selling a property for a total of Php 2400000 then the capital gains tax will amount to Php 144000. Under the TRAIN law it will now be subject to a flat rate of 6 percent. The rate is between 05 -075 varying between municipalities Paid on the highest of the three values listed above Source 1 Source 2 Source 3 3 January 2018.

Source: pinterest.com

Source: pinterest.com

Capital Duty Non-Tax Planning. If youre selling a property for a total of Php 2400000 then the capital gains tax will amount to Php 144000. Sale of real property is subject to capital gains tax at the rate of 6 on the higher of the gross selling price or fair market value. Estate tax is imposed on the transfer of the net estate which is the difference between the gross estate as defined under Section 85 of the Tax Code and allowable deductions under Section 86 of the decedent. What are the real property tax rates.

Source: rappler.com

Source: rappler.com

It provides for a fi xed 6 tax rate of the total net estate of persons who died on or before Dec. Capital Duty Non-Tax Planning. Implements the provisions of Estate Tax Amnesty pursuant to the provisions of Republic Act No. It differs from the inheritance tax or estate tax because its given by someone who is still living. Net Estate Gross Estate Deductions.

Source: ndvlaw.com

Source: ndvlaw.com

The real property tax rate for Metro Manila is 2 of the assessed value of the property while the provincial rate is 1. Valuation of real property is subject to periodic appraisal by the local government. Theres also a different tax in the Philippines on the transfer itself. 4-2019 relative to the availment period for the Tax Amnesty on Delinquencies Published in Manila Bulletin on March 24 2020 Digest Full Text. The gift tax applies whether the.

Source: propertywalls.blogspot.com

Source: propertywalls.blogspot.com

VAT on sale and lease of real properties Beginning 1 January 2021 the VAT exemption shall only apply to sale of real properties not primarily held for sale to. Theres also a different tax in the Philippines on the transfer itself. The real property tax rate for Metro Manila is 2 of the assessed value of the property while the provincial rate is 1. Estate tax rates are graduated and depend on the net estate amount. 12-2018 which contains the implementing guidelines related to the revised Estate Tax and Donors Taxes to be used starting 2018 as mandated in the TRAIN bill signed into law by Pres.

Source: pinterest.com

Source: pinterest.com

Under the Tax Reform for Acceleration and Inclusion TRAIN law the estate tax is only 6 of the net estate the estate tax previously ranged from 5 to 20 of the net estate. It differs from the inheritance tax or estate tax because its given by someone who is still living. What are the real property tax rates. Heres a sample computation of capital gains tax on sale of property. General Guideline for Capital Gain Tax Real Property Tax or Amilyar Documentary Stam Tax other Real Estate Taxes.

Source: federalland.ph

Source: federalland.ph

31 2017 and grants immunity from all other estate taxes and penalties incurred in the past. Theres also a different tax in the Philippines on the transfer itself. Estate tax is imposed on the transfer of the net estate which is the difference between the gross estate as defined under Section 85 of the Tax Code and allowable deductions under Section 86 of the decedent. According to Section 24D all real properties have a capital gains tax of six percent which is based on the gross selling price or current fair market valuewhichever one is higher of the two. Sale of real property is subject to capital gains tax at the rate of 6 on the higher of the gross selling price or fair market value.

Source: fi.pinterest.com

Source: fi.pinterest.com

Theres also a different tax in the Philippines on the transfer itself. 12-2018 which contains the implementing guidelines related to the revised Estate Tax and Donors Taxes to be used starting 2018 as mandated in the TRAIN bill signed into law by Pres. It differs from the inheritance tax or estate tax because its given by someone who is still living. Implements the provisions of Estate Tax Amnesty pursuant to the provisions of Republic Act No. The real property tax rate for Metro Manila is 2 of the assessed value of the property while the provincial rate is 1.

Source: statista.com

Source: statista.com

Net Estate Gross Estate Deductions. Theres also a different tax in the Philippines on the transfer itself. 4-2019 relative to the availment period for the Tax Amnesty on Delinquencies Published in Manila Bulletin on March 24 2020 Digest Full Text. If youre selling a property for a total of Php 2400000 then the capital gains tax will amount to Php 144000. 10963 There shall be an imposed rate of six percent 6 based on the value of such NET ESTATE determined as of the time of death of decedent composed of all properties real or personal tangible or intangible less allowable deductions.

Source: federalland.ph

Source: federalland.ph

The seller rumored to be Roque Tordesillas of Marsh Philippines paid total Capital Gains Tax of P2328 million Manny Pacquiao as buyer paid a total of P873 million for documentary stamps tax and transfer tax Thats a lot of taxes in one single real estate transaction. Implements the provisions of Estate Tax Amnesty pursuant to the provisions of Republic Act No. 31 2017 and grants immunity from all other estate taxes and penalties incurred in the past. General Guideline for Capital Gain Tax Real Property Tax or Amilyar Documentary Stam Tax other Real Estate Taxes. Under RR 6-2019 the minimum estate amnesty tax for the transfer of the estate of each decedent will be P5000.

Stamp duty of Php 15 for every Php 1000 will apply to the transfer of real property. The exact tax rates depend on the location of the property. The rate is between 05 -075 varying between municipalities Paid on the highest of the three values listed above Source 1 Source 2 Source 3 3 January 2018. Theres also a different tax in the Philippines on the transfer itself. The seller rumored to be Roque Tordesillas of Marsh Philippines paid total Capital Gains Tax of P2328 million Manny Pacquiao as buyer paid a total of P873 million for documentary stamps tax and transfer tax Thats a lot of taxes in one single real estate transaction.

Source: pinterest.com

Source: pinterest.com

10963 There shall be an imposed rate of six percent 6 based on the value of such NET ESTATE determined as of the time of death of decedent composed of all properties real or personal tangible or intangible less allowable deductions. Capital Duty Non-Tax Planning. Heres a sample computation of capital gains tax on sale of property. Estate tax rates are graduated and depend on the net estate amount. It differs from the inheritance tax or estate tax because its given by someone who is still living.

Source: lamudi.com.ph

Source: lamudi.com.ph

Capital Duty Non-Tax Planning. The National Grid Corporation of the Philippines and distribution companies including electric cooperatives shall be subject to 12 VAT. Heres a sample computation of capital gains tax on sale of property. According to the finance chief the estate tax amnesty program would be legislated under the Tax Reform for Acceleration and Inclusion Act TRAIN. Previously a tax based on the value of the net estate of the decedent whether resident or nonresident of the Philippines was computed based on a tax schedule where an estate worth P200000 and over was taxed from 5 percent to 20 percent.

Source: pinterest.com

Source: pinterest.com

Estate tax rates are graduated and depend on the net estate amount. Theres also a different tax in the Philippines on the transfer itself. Estate tax rates are graduated and depend on the net estate amount. The Philippines refers to this tax as the donors tax and its imposed on the transfer of real personal tangible or intangible property between two or more people who are living at the time of the transfer when this is given as a gift and no money exchanged hands. Estate tax is imposed on the transfer of the net estate which is the difference between the gross estate as defined under Section 85 of the Tax Code and allowable deductions under Section 86 of the decedent.

Source: pinterest.com

Source: pinterest.com

31 2017 and grants immunity from all other estate taxes and penalties incurred in the past. What are the real property tax rates. The Bureau of Internal Revenue BIR has released Revenue Regulations No. According to the finance chief the estate tax amnesty program would be legislated under the Tax Reform for Acceleration and Inclusion Act TRAIN. It provides for a fi xed 6 tax rate of the total net estate of persons who died on or before Dec.

Source: pinterest.com

Source: pinterest.com

Implements the provisions of Estate Tax Amnesty pursuant to the provisions of Republic Act No. The rate is between 05 -075 varying between municipalities Paid on the highest of the three values listed above Source 1 Source 2 Source 3 3 January 2018. Real property tax rates at 1 to 2 of assessed value Under Section 233 of the Local Government Code of 1991 the following rates of basic real property tax are prescribed based on assessed values of real properties in the Philippines. If youre selling a property for a total of Php 2400000 then the capital gains tax will amount to Php 144000. Implements the provisions of Estate Tax Amnesty pursuant to the provisions of Republic Act No.

Source: pinnacle.ph

Source: pinnacle.ph

Real property tax rates at 1 to 2 of assessed value Under Section 233 of the Local Government Code of 1991 the following rates of basic real property tax are prescribed based on assessed values of real properties in the Philippines. The rate is between 05 -075 varying between municipalities Paid on the highest of the three values listed above Source 1 Source 2 Source 3 3 January 2018. What are the real property tax rates. Stamp duty of Php 15 for every Php 1000 will apply to the transfer of real property. Sale of real property is subject to capital gains tax at the rate of 6 on the higher of the gross selling price or fair market value.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title real estate tax philippines 2018 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.